We’ll make sure you are fully aware of upcoming dates and deadlines at HMRC.

It is important to keep up to date with deadlines and legislation, so we’ve put together a summary of dates to keep you informed on crucial dates for your calendar!

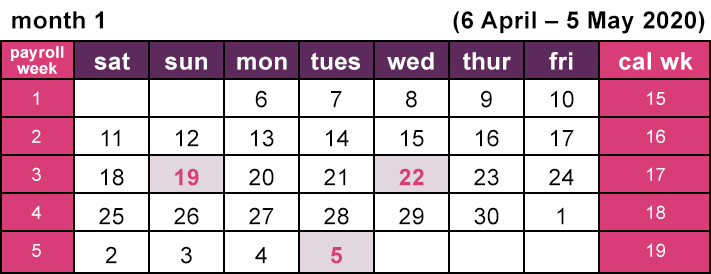

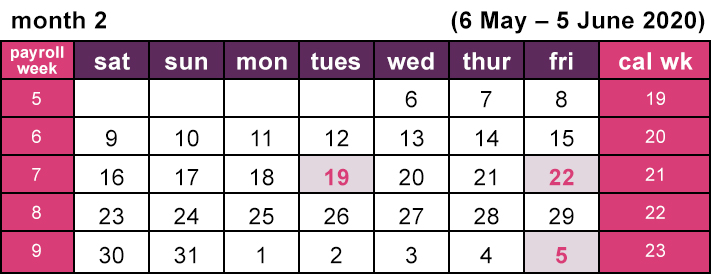

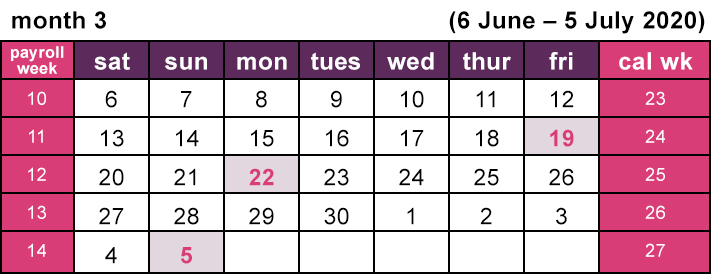

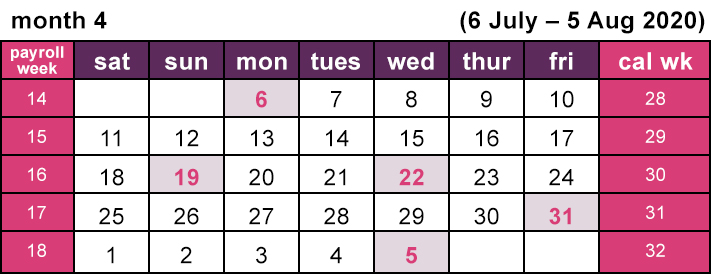

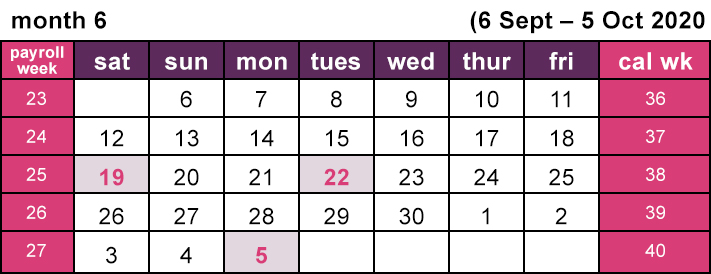

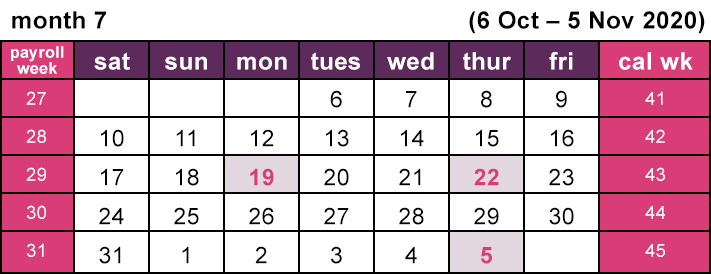

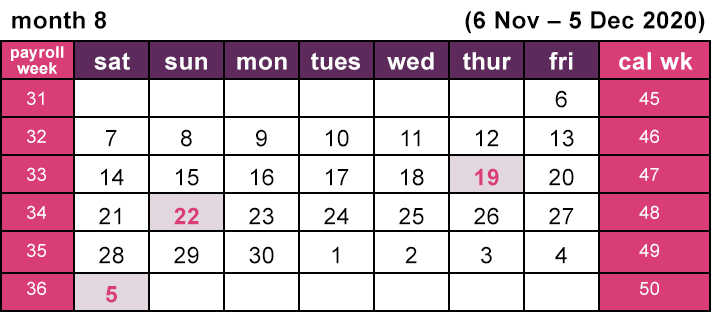

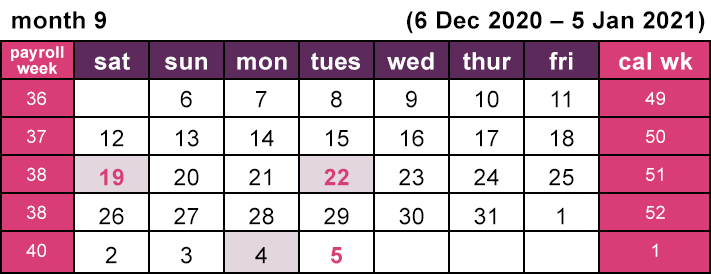

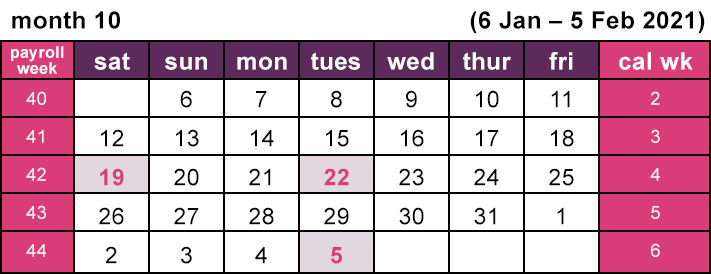

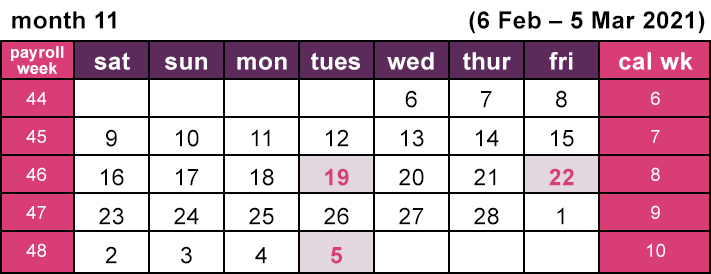

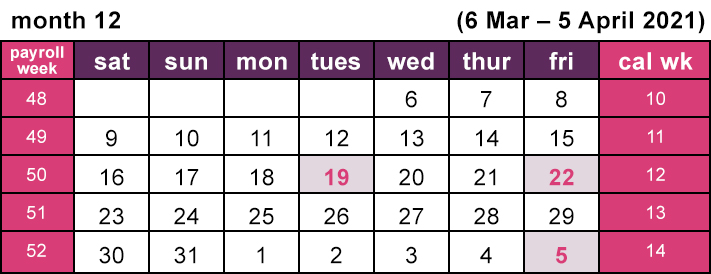

A staging date for a new group of companies.

The month end date for PAYE.

Deadline date for payment of PAYE and NICs etc to HMRC’s Accounts Office by non-electronic method. Last day for submitting a real time information employer payment summary to apply to tax month.

Deadline for payment of PAYE and NICs etc to HMRC’s Accounts Office by electronic method.

By 31st May each year, employers must give a form P60 to each employee working for them at 5 April, and for whom they have filed a FPS.

Filing deadline date for Expenses & Benefits Forms P11D(b), P9D and P11D to reach HMRC.

Last date for you to give forms P9D and P11D to relevant employees. Last date for Employee Share Scheme Annual Return Form 42 to reach HMRC.

PAYE and Class 1 A NIC payment due date if paying by non-electronic method.

PAYE and Class 1 A NIC payment due date if paying by electronic method.

PAYE settlement agreement submission date.

PAYE and Class 1 B NIC payment due date if paying by non-electronic method.

PAYE and Class 1 B NIC payment due date if paying by electronic method.

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 |

| Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 |